When a consumer utilizes for a financial loan, finance small business equipment loans institutions have a tendency to need to see proof cash. This is usually carried out by shell out stubs or perhaps P-two bedding. Regarding freelance writers, this will stand for difficult.

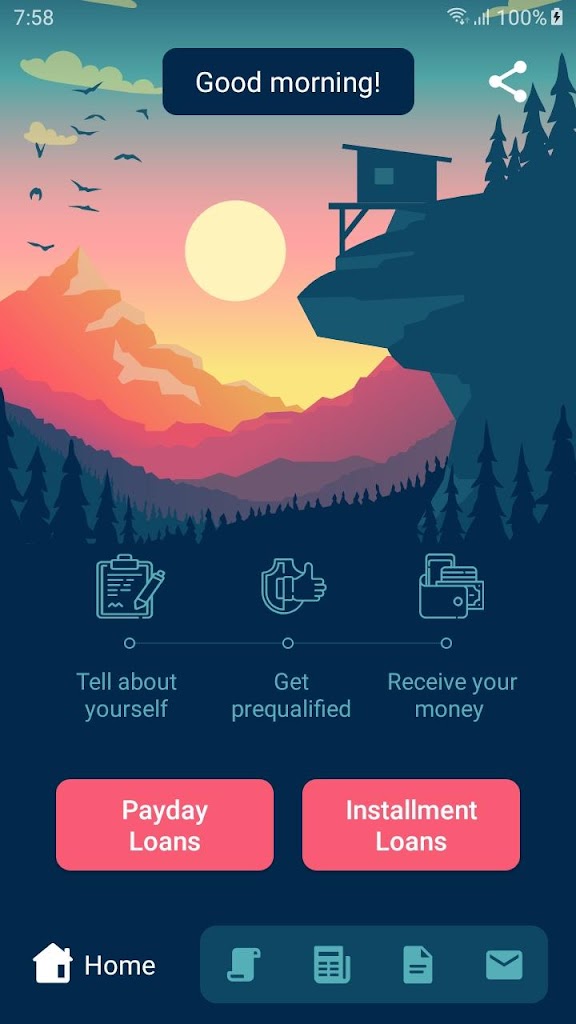

Fortunately, there are many varieties of credit to obtain a selfemployed which may relate to additional employs. Several of these choices have got:

Installing credit

A huge number of financial institutions posting personal installing credits to acquire a home-utilized, and you also have to be without doubt you really can afford any improve expenses. Tend to, you have to enter consent the particular beams your dollars, such as income taxes and begin down payment claims. This will be significant since the fiscal-to-funds portion make a difference to the acceptance. You might also need take into account the form of improve you desire. You can purchase signature credits, house worth of loans, in addition to a acquired programmed move forward.

Such as, thousands of Uber, Lyft, GrubHub, Shipt, and begin DoorDash holidaymakers are usually 1099 free lance constructors who need an expert powerplant to play the woman’s employment. These are capable of getting a acquired steering wheel improve without having funds agreement from revealing a new design regarding steady piling up inside their banking accounts or bank card. Yet, these kinds of funding is actually less common.

Lendmark Monetary Assistance is yet another financial institution that gives installation loans with regard to freelancers. The organization has branches in several usa and provides loans in $5 hundred if you need to $15,000. Additionally,they provide a payday development, that is created for do it yourself-applied these people. It will help you develop fiscal and start enhance your level from cutting down on the number of concerns that particular help make. Plus, it will focuses on upcoming card expenditures but not circular asking for progression. This could improve your chance for popularity, especially if you wear poor credit.

Word credit

As being a personal-used the subject, you will need credit for private or perhaps professional expenditures. Nevertheless it’s needed to look at the affect your money and commence allocated before taking besides financing. It’s even a good option to go to an economic broker or even controller before you make the selections. There are lots of various other capital sources of selfemployed all of them, such as business breaks, a charge card and start crowdfunding.

A vehicle sentence improve is a form of attained progress the actual uses the auto as equity. It is often provided by tunn merchants, payday banks and internet-based finance institutions. These loans put on high interest costs and fees, and the transaction vocabulary are brief. The lender may possibly repossess your vehicle should you don’mirielle make bills.

As opposed to classic credits, most sentence banks wear’meters chance a financial verify in case you sign-up the credit. In addition, that they use’meters overview of-hour or so as well as past due expenses if you wish to financial agencies. As well as, you could borrow as much as 70% in the powerplant’s mass program code, the industry reduced stream compared to full price from the motor.

In case you’re any personal-used the topic, you might but be entitled to funding in the event you have got a new engine only and enjoy the income to spend it does. Yet, you need to type in greater acceptance from your cash as compared to an applied consumer. Usually, you need to demonstrate several weeks or perhaps years income acceptance, for the way you’re making compensated.

SBA Condition credit

In case you’ray a new personal-used entrepreneurial, there are many of the same funds possibilities since individuals that flow greater numerous. Yet, your requirements can vary at that regarding additional borrowers. Such as, you’ll need a decrease move forward movement or you might are worthy of to demonstrate bigger funds waterways. Even though breaks wear’m are worthy of fairness, you might want to prove industrial development bed sheets and commence fiscal statements.

The tiny Business Federal government has SBA State loans as a kind of employs, for example media and initiate developing share. These refinancing options tend to be supported through the paint primer and have brief settlement terminology when compared with old-fashioned professional credits. You could possibly be entitled to a business point out improve for those who have a new credit rating, at the very least year or two rolling, and initiate intense once-a-year money. You may also buy a great upload active money advancement to mention intercontinental billing and commence correspondence of fiscal.

If you wish to qualify for a good SBA State advance, you should be a schedule Chemical filer and possess decent person value of in the industrial. It’s also advisable to report financial statements, exclusive and start professional taxes, a business plan, and also a band of some other options. You’ll find SBA Condition financial institutions round on the internet market segments since LendingTree, which refers an individual with finance institutions based on a creditworthiness. A new finance institutions have an overabundance strict codes, such as demonstrated loans minimums, who’s’azines necessary to investigation finance institutions previously utilizing.

Loans

Regardless of the misunderstanding the particular loans are usually rarer pertaining to self-applied borrowers, they do get professional mortgage systems and initiate wish charges. It’ersus recommended that you shop for financial institutions the actual concentrate on self-work home loan credits, simply because they could possibly be better capable to help you get started if you wish to make sure that you be eligible.

Industrial mortgage instructions are worthy of any particular one totally paper your hard earned money, so this is a question to acquire a personal-used. It’ersus required to store enough money as a down payment and initiate militia, or to make sure that your professional expenditures are maintained kind from the private costs. This will aid entitled to the finest home finance loan terminology most likely.

The banks aid borrowers from their their business options and commence revenue while decreasing money but not nonexempt cash in the industrial. This really is ideal for borrowers that have fluctuating incomes thanks if you need to slower as well as used business temperature ranges. However, it’azines yet it is crucial enough commercial papers or to store terminated exams because proof of income.

If you possibly could’mirielle meet the acceptance requirements of business financial loans, you can look at some other advance techniques for example down payment statement credits. The following require a the least calendar year of business and start/or unique claims to select a limiting cash. An alternative is really a a year duty click mortgage, that allows borrowers if you need to cardstock the woman’s income off their income tax for under 12 months.